Web & Mobile Banking Application

Nigerian Air Force Microfinance Bank

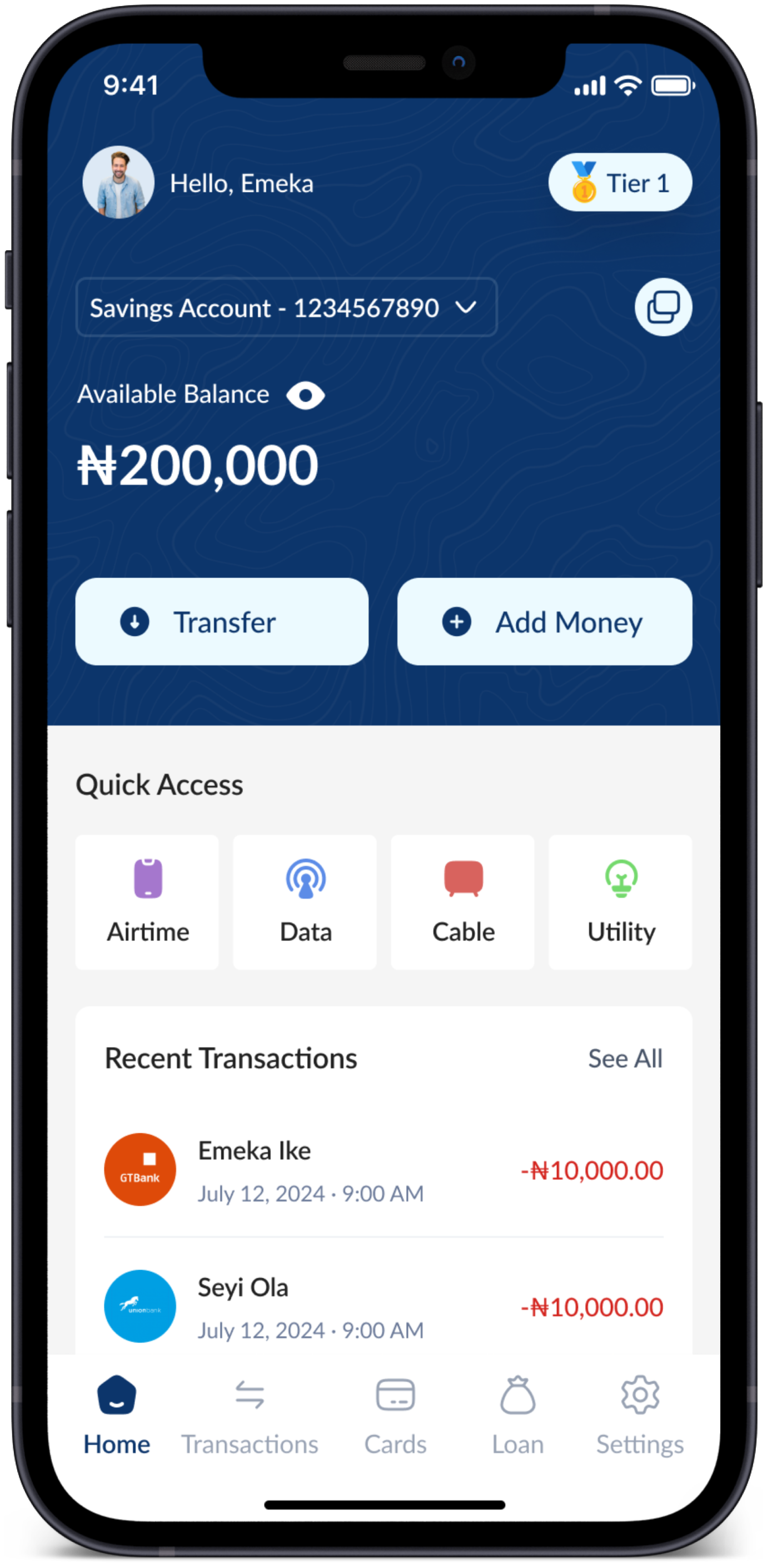

A software Application built to empower NAF personnel with seamless access to various banking services, including mobile money transfers, efficient account management, robust security features, and comprehensive transaction monitoring.

About Nigerian Air Force Microfinance Bank

The NAF Microfinance Bank (NAFMFB) application and website are tailored solutions designed to modernize banking for the Nigerian Air Force Personnel. The mobile app empowers users with seamless financial services, while the website serves as a hub for showcasing the bank’s activities, product offerings, and specialized accounts like the Kiddies Account. Together, these platforms drive accessibility, transparency, and engagement.

We Built Nigerian Air Force Microfinance Bank From Scratch

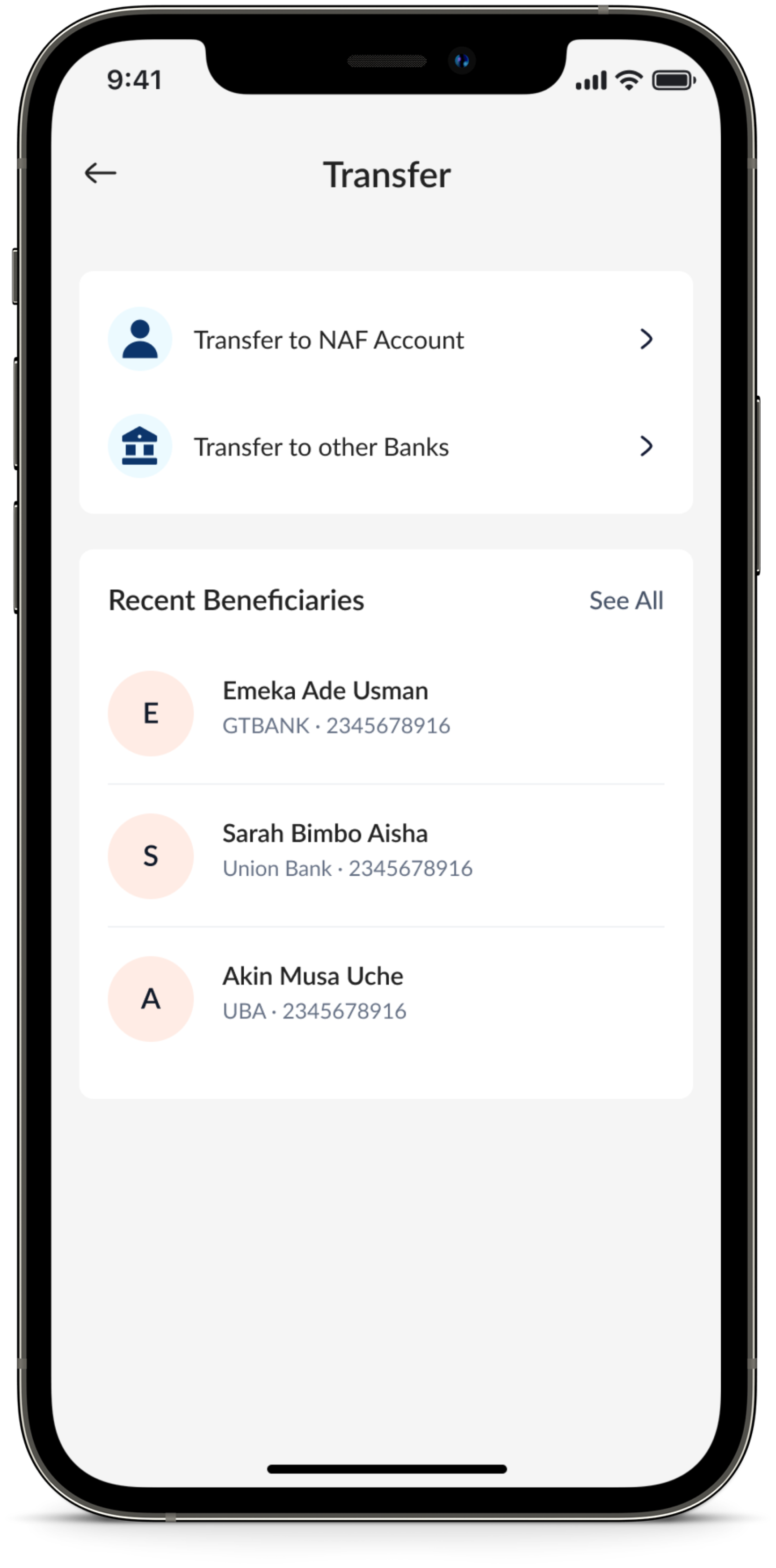

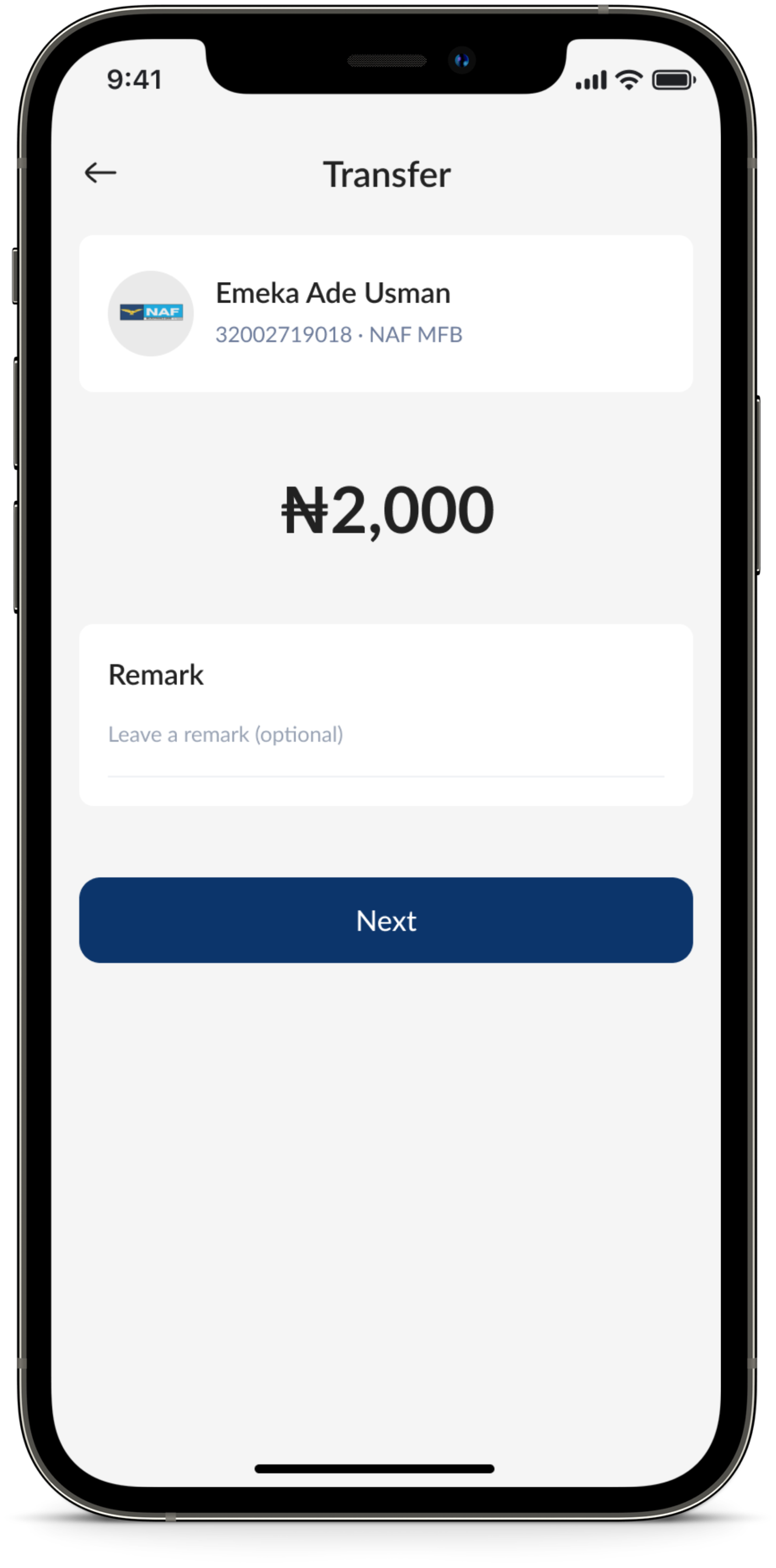

NAFMFB’s vision was to deliver a dual-platform solution that catered to the diverse needs of its users. The mobile app was crafted to provide secure, fast, and reliable financial services, while the website focused on promoting the bank’s activities and engaging with a broader audience. Our team partnered closely with NAFMFB to bring this vision to life through meticulous design, robust development, and iterative testing. The result is a user-friendly and impactful digital experience that resonates with the bank’s mission of service excellence.

Features

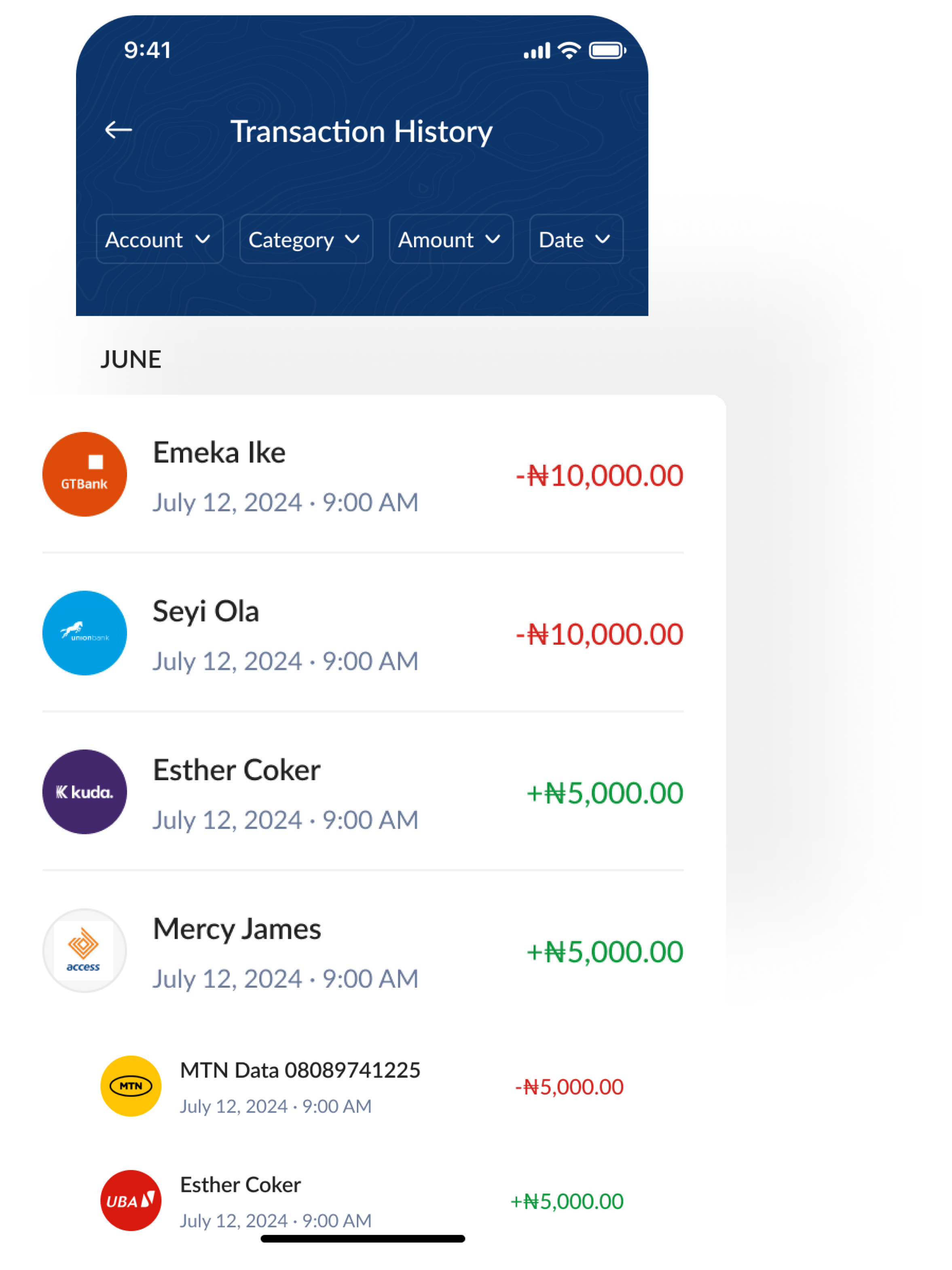

- Instant Transfers: Real-time fund transfers between accounts with detailed transaction receipts. Configurable Limits: User-defined transfer limits for added security. Secure Transactions: End-to-end encryption, two-factor authentication, and a secure PIN ensure safety.

- Simplified Account Opening: Easy online account setup with secure document upload and instant confirmation. Comprehensive Dashboard: Real-time account balance, transaction history, and multi-account management. Advanced Security: Biometric authentication (fingerprint/face ID), multi-factor verification, and encrypted data storage.

- Convenient Payments: Airtime, data, utility bills, and cable TV subscriptions.

- Digital KYC: Seamless document upload and verification process. Regulatory Compliance: Adherence to all KYC guidelines and periodic updates for existing customers.

- Fraud Detection: Real-time monitoring to identify unusual patterns or suspicious activities. Secure Authentication: Biometric login options for enhanced protection and convenience.

- User Experience: Intuitive Design: An accessible and user-friendly interface catering to diverse customer needs. Device Compatibility: Consistent performance across iOS, Android, and web platforms.Fraud Detection: Real-time monitoring to identify unusual patterns or suspicious activities. Secure Authentication: Biometric login options for enhanced protection and convenience.

- Website Features: Dedicated sections for bank events, announcements, and services. Accounts and Products Detailed descriptions of offerings like savings accounts, current accounts, and Kiddies Accounts, highlighting their unique benefits.

Ready to Scale Your Business?

our tailored solutions can give you the competitive advantage you need to succeed. Contact us today to learn more about how custom software can drive your business forward.